The Mahama-led government has borrowed a total of GHȼ59.68 billion from the domestic money market within the first seven weeks of assuming office in 2025. This borrowing, conducted through the issuance of 91-day, 182-day, and 365-day Treasury Bills, reflects the government’s reliance on short-term domestic borrowing to manage its financial obligations.

Breakdown of Borrowing Activity

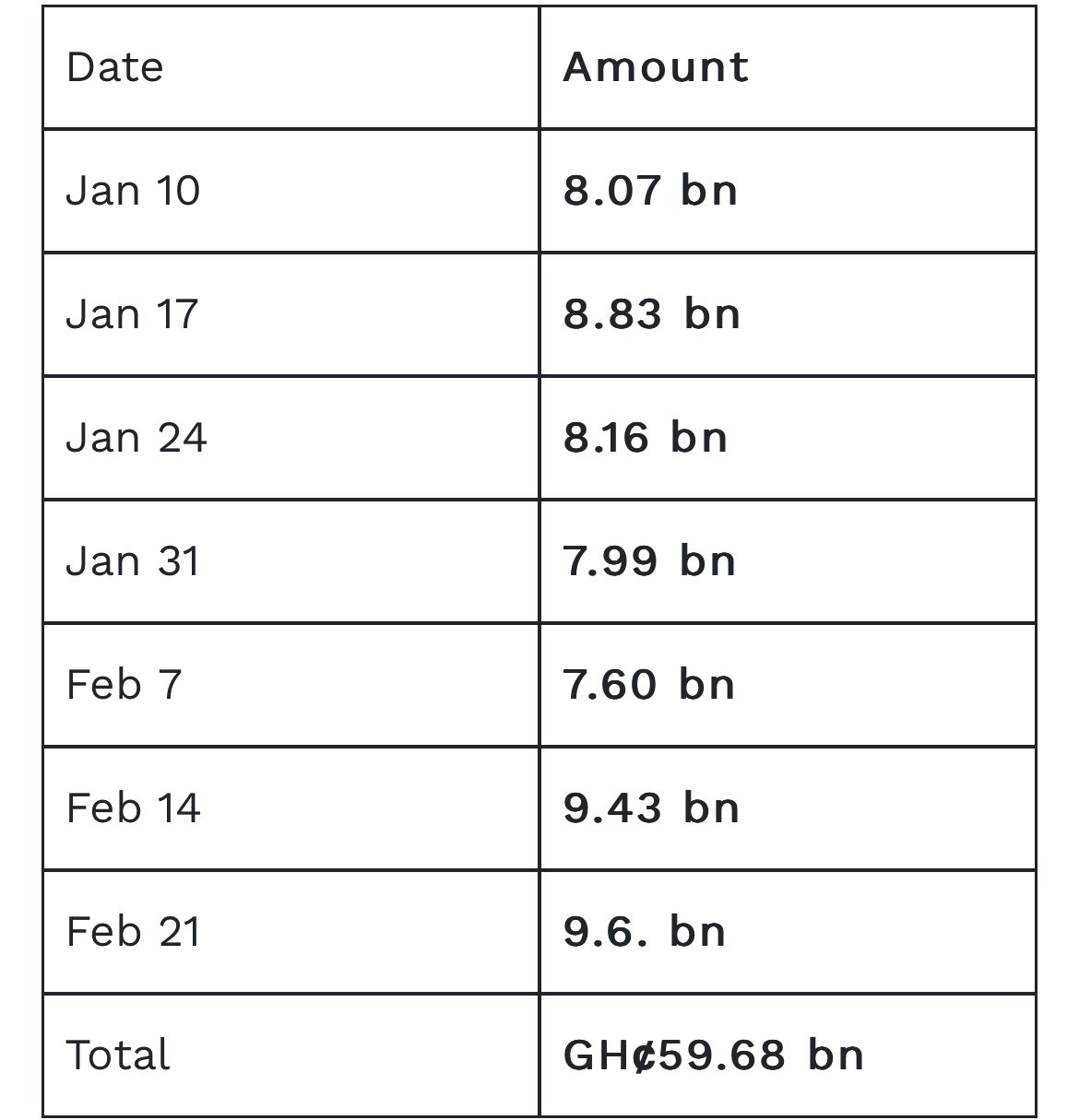

According to data from the Bank of Ghana, the government first accessed the Treasury Bill market on January 10, just three days after taking office, securing GHȼ8.07 billion. This was followed by additional borrowings on:

• January 17 – GHȼ8.83 billion

• January 24 – GHȼ8.16 billion

• January 31 – GHȼ7.99 billion

In February, the government continued its borrowing spree, raising:

• February 7 – GHȼ7.60 billion

• February 14 – GHȼ9.43 billion

• February 21 – GHȼ9.6 billion

The government’s consistent presence in the Treasury Bill market suggests a strategy to finance its short-term expenditures while potentially addressing budgetary constraints. However, this level of borrowing raises concerns about interest costs and potential pressure on liquidity in the domestic financial sector.

Analysts will be watching closely to see how the government manages its debt sustainability and whether this pattern of borrowing continues in the coming months. The reliance on short-term instruments also raises questions about the government’s long-term fiscal strategy, especially in the face of existing economic challenges.

The table below shows a breakdown of the government’s borrowing from the Domestic Bond Market in 2025 (Treasury Bill Auctions) between January 10th – February 21 2025: