President John Dramani Mahama’s first budget, set for March, is expected to abolish the controversial E-Levy, a move that will create a GH¢10 billion revenue shortfall. To offset the lost revenue, the government is considering an increase in the Communications Service Tax (CST) from 6% to 10%, effectively shifting the burden to telecommunications companies.

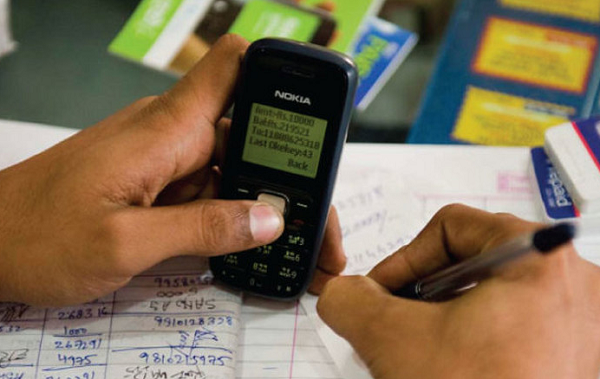

The Electronic Transactions Levy (E-Levy), introduced by the previous government, was met with widespread public backlash due to its impact on mobile money transactions and digital payments. Mahama had campaigned on a promise to remove the tax, arguing that it was burdensome on ordinary Ghanaians.

However, the decision to abolish the E-Levy will leave a significant hole in government revenue, estimated at GH¢10 billion annually.

To bridge this gap, the government is reportedly planning to increase the Communications Service Tax (CST) from 6% to 10%, a move that could raise costs for telecom operators and potentially lead to higher service charges for consumers. While the tax increase targets telecom companies, industry experts warn that the cost may eventually be passed down to consumers, affecting call, data, and mobile money charges.

As Mahama prepares to present his first budget, he faces the challenge of keeping his campaign promises while ensuring adequate revenue generation for government operations.